Taras Shevchenko Kyiv National University

Faculty of Economics

Semester Project

European Monetary Union: Theory, History and Consequences

MA. Amalya Tumanyan

Kyiv 2009

CONTENTS

Introduction

1. What is the European Monetary Union?

2. History of the EMU

3.Criticisms of the EMU

Summary

INTRODUCTION

A monetary union is a situation where several countries have agreed to share a single currency amongst themselves.

Economic and Monetary Union (EMU) represents a major step in the integration of EU economies. It involves the coordination of economic and fiscal policies, a common monetary policy, and a common currency, the euro. Whilst all 27 EU Member States take part in the economic union, some countries have taken integration further and adopted the euro. Together, these countries make up the euro area.

The decision to form an Economic and Monetary Union was taken by the European Council in the Dutch city of Maastricht in December 1991, and was later enshrined in the Treaty on European Union (the Maastricht Treaty). Economic and Monetary Union takes the EU one step further in its process of economic integration, which started in 1957 when it was founded. Economic integration brings the benefits of greater size, internal efficiency and robustness to the EU economy as a whole and to the economies of the individual Member States. This, in turn, offers opportunities for economic stability, higher growth and more employment – outcomes of direct benefit to EU citizens. In practical terms, EMU means:

- Coordination of economic policy-making between Member States

- Coordination of fiscal policies, notably through limits on government debt and deficit

- An independent monetary policy run by the European Central Bank (ECB)

- The single currency and the euro area

1. WHAT IS THE EUROPEAN MONETARY UNION?

A monetary union is a situation where several countries have agreed to share a single currency amongst themselves. The European Economic and Monetary Union (EMU) consists of three stages coordinating economic policy and culminating with the adoption of the euro, the EU's single currency. All member states of the European Union are expected to participate in the EMU. Sixteen member states of the European Union have entered the third stage and have adopted the euro as their currency. The United Kingdom, Denmark and Sweden have not accepted the third stage and the three EU members still use their own currency today.

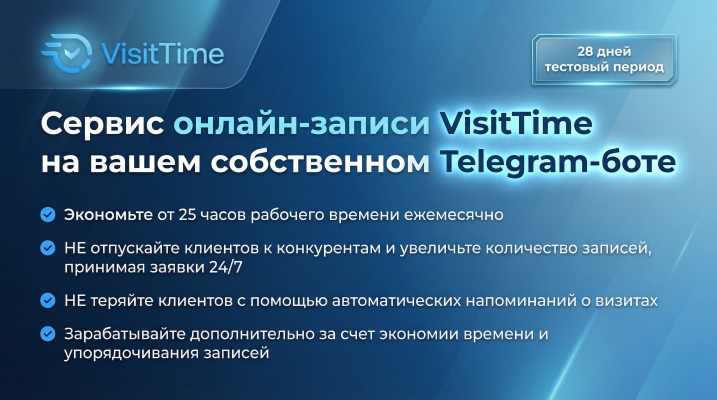

Реклама

Among the European states, EMU officially stands for Economic and Monetary Union. Other countries also use EMU to refer generally to the European Monetary Union. EMU is the agreement among the participating member states of the European Union to adopt a single hard currency and monetary system. The European Council agreed to name this single European currency the Euro. The European states decided that the EMU and a single European market were essential to the implementation of the European Union, which was created to advance economic and social unity among the peoples of Europe and to propel Europe to greater prominence in the international community.

2. HISTORY OF THE EMU

The road to EMU

First ideas of an economic and monetary union in Europe were raised well before establishing the European Communities. For example, already in the League of Nations, Gustav Stresemann asked in 1929 for a European currency against the background of an increased economic division due to a number of new nation states in Europe after WWI.

Economic and monetary union was a recurring ambition for the European Union from the late 1960s onwards because it promised stability and an environment for higher growth and employment.

The road towards today's Economic and Monetary Union and the euro area can be divided into four phases:

Phase 1: From the Treaty of Rome to the Werner Report, 1957 to 1970

The international currency stability that reigned in the immediate post-war period did not last. Turmoil on international currency markets between 1968 and 1969 threatened the common price system of the common agricultural policy, a main pillar of what was then the European Economic Community. In response to this troubling background, Europe's leaders set up a high-level group led by Pierre Werner, the Luxembourg Prime Minister at the time, to report on how EMU could be achieved by 1980.

Phase 2: From the Werner Report to the European Monetary System, 1970 to 1979

The Werner group set out a three-stage process to achieve EMU within ten years, including the possibility of a single currency. The Member States agreed in principle in 1971 and began the first stage – narrowing currency fluctuations. However, a fresh wave of currency instability on international markets squashed any hopes of tying the Community's currencies closer together. Subsequent attempts at achieving stable exchange rates were hit by oil crises and other shocks until, in 1979, the European Monetary System (EMS) was launched.

Реклама

Phase 3: From the start of EMS to Maastricht, 1979 to 1991

The EMS was built on exchange rates defined with reference to a newly created ECU (European Currency Unit), a weighted average of EMS currencies. An exchange rate mechanism (ERM) was used to keep participating currencies within a narrow band. The EMS represented a new and unprecedented coordination of monetary policies between the Member States, and operated successfully for over a decade.

This success provided the impetus for further discussions between the Member States on achieving economic and monetary union. At the request of the European leaders, the European Commission President, Jacques Delors, and the central bank governors of the EU Member States produced the 'Delors Report' on how EMU could be achieved.

Phase 4: From Maastricht to the euro and the euro area, 1991 to 2002

The Delors Report proposed a three-stage preparatory period for economic and monetary union and the euro area, spanning the period 1990 to 1999.

The Delors Report recommended EMU in three stages

The report indicated that this could be achieved in three stages, moving from closer economic and monetary coordination to a single currency with an independent European Central Bank and rules to govern the size and financing of national budget deficits.

The three stages towards EMU

| Stage 1 (1990-1994) |

Complete the internal market and remove restrictions on further financial integration. |

| Stage 2 (1994-1999) |

Establish the European Monetary Institute to strengthen central bank co-operation and prepare for the European System of Central Banks (ESCB). Plan the transition to the euro. Define the future governance of the euro area (the Stability and Growth Pact). Achieve economic convergence between Member States. |

| Stage 3 (1999 onwards) |

Fix final exchange rates and transition to the euro. Establish the ECB and ESCB with independent monetary policy-making. Implement binding budgetary rules in Member States. |

European leaders accepted the recommendations in the Delors Report. The new Treaty on European Union, which contained the provisions needed to implement EMU, was agreed at the European Council held at Maastricht, the Netherlands, in December 1991. This Council also agreed the 'Maastricht convergence criteria' that each Member State would have to meet to participate in the euro area.

After a decade of preparations, the euro was launched on 1 January 1999. At the same time, the euro area came into operation, and monetary policy passed to the European Central Bank (ECB), established a few months previously – 1 June 1998 – in preparation for the third stage of EMU. After three years of working with the euro as 'book money' alongside national currencies, euro coins and banknotes were launched on 1 January 2002 and the biggest cash changeover in history took place.

3.Criticisms of the EMU

Concerns about the EMU center around loss of national sovereignty for each of the individual participating states. Some fear that the participating states may not be able to pull out of a national economic crisis without the ability to devalue its national currency and encourage exports. Others worry that the participating European states will be forced to give tax breaks to compete with each other and that companies may have to lower wages for their employees and to lower prices on goods that they produce. Because taxes continue to be levied at the national level and not by the EMU, tax policy cannot be used as a tool to help individual states that may be experiencing an economic downturn. In this way, the EMU differs from the United States which has both a single federal monetary policy and a primarily centralized tax system. In the United States, the residents of an individual state with a lagging economy can pay less tax and the residents of another state with a soaring economy can make up some of the tax deficit. In the EMU, because tax policy is not centralized, the other states cannot help out an individual participating state that is economically troubled by shouldering a greater proportion of the tax burden. Also, because the participating EMU countries vary so much culturally, the labor force in these countries is not nearly as mobile as between the states of the United States. Because the labor force is fairly stationary, problems of high unemployment may persist in certain individual EMU states while other countries may not be able to fill positions with qualified employees. Finally, some countries (like the United Kingdom) may fear that joining the EMU may pull their country down to the economic equivalent of the least common denominator, saddling them with the economic problems of countries with a less successful economy.

SUMMARY

EMU is the agreement among the participating member states of the European Union to adopt a single hard currency and monetary system. The European Council agreed to name this single European currency the Euro.

Economic and monetary union was a recurring ambition for the European Union from the late 1960s onwards because it promised stability and an environment for higher growth and employment.

The road towards today's Economic and Monetary Union and the euro area can be divided into four phases:

- Phase 1: From the Treaty of Rome to the Werner Report, 1957 to 1970

- Phase 2: From the Werner Report to the European Monetary System, 1970 to 1979

- Phase 3: From the start of EMS to Maastricht, 1979 to 1991

- Phase 4: From Maastricht to the euro and the euro area, 1991 to 2002

The transition to EMU is combined with benefits and costs:

Benefits:

1. The abolishment of intra-european currency crises as a consequence of independent national monetary policies under high capital mobility.

2. A reduction of monetary risks by the pooling of risks and an increase of the potential for stability within Europe.

3. A reduction of transactions costs and, as a consequence, an improvement of the resource allocation.

4. The avoidance of unnecessary adjustment burdens in the real economy.

5. The elimination of beggar-my-neighbour-policies by the choice of exchange rates.

6. The abolishment of market segmentation due to exchange rates, an increase in market transparency and a reduction of price discriminations.

Costs:

1. In the FRG, we cannot choose anymore an inflation rate independently of the other countries.

2. The exchange rate instrument is lost as an adjustment mechanism. On one side, this loss is justified by the fact that the need for exchange rate adjustments will disappear due to the unified monetary policy in EMU. On the other side, for the real economy only a knife with two cutting edges gets lost which in addition is not permamently but only transitorily effective.

EXTERNAL LINKS

1. EMU: A Historical Documentation (European Commission)/http://ec.europa.eu/economy_finance/emu_history/index_en.htm

2. The euro (European Commission Economic and Financial Affairs)/http://ec.europa.eu/economy_finance/the_euro/index_en.htm?cs_mid=2946

3. The euro and other currency unions in history/http://samvak.tripod.com/nm032.html

4. What is the European Monetary Union? University of Iowa Center for International Finance and Development /http://www.uiowa.edu/ifdebook/faq/faq_docs/EMU.shtml

|